What Is a Balance Sheet? Definition, Explanation and Format Examples

An asset is a resource that is owned or controlled by the company to be used for future benefits. Some assets are tangible like cash while others are theoretical or intangible like goodwill or copyrights. In other words, all assets initially come from liabilities and owners’ contributions. Drawings are amounts taken out of the business by the business owner.

Final Thoughts On Calculating The Equation

To further illustrate the analysis of transactions and their effects on the basic accounting equation, we will analyze the activities of Metro Courier, Inc., a fictitious corporation. Refer to the chart of accounts illustrated in the previous section. In order to get a more accurate understanding of the company, business owners and investors should review other financial statements, such as the income statement and cash flow statement. In order to get a complete understanding of the company, business owners and investors should review other financial statements, such as the income statement and cash flow statement. Below the assets are the liabilities and stockholders’ equity, which include current liabilities, noncurrent liabilities, and shareholders’ equity.

Balance Sheets Are Subject to Several Professional Judgment Areas That Could Impact the Report

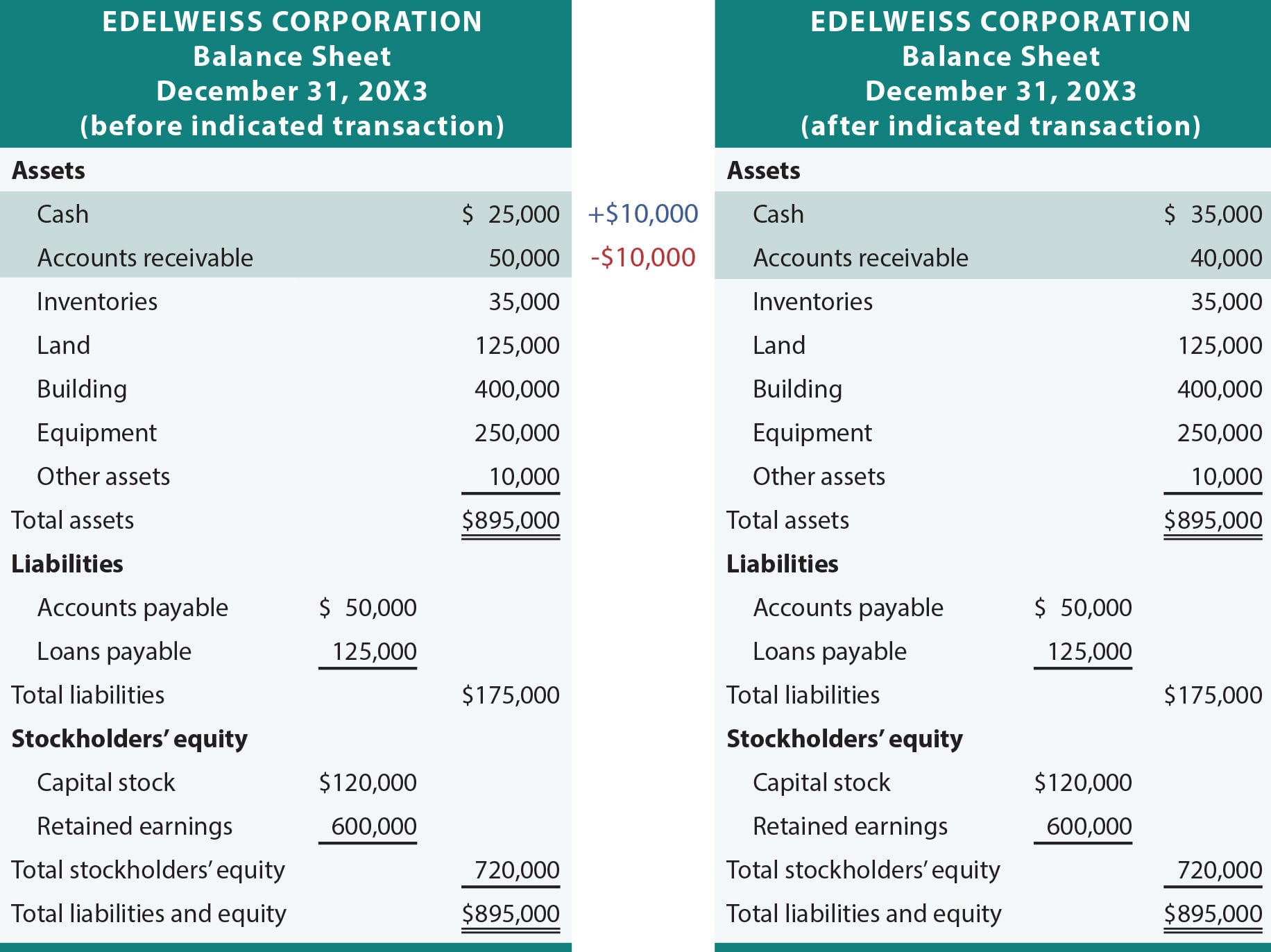

This includes all money owed to creditors, like payroll liabilities, accounts payable, costs for rent or mortgage, loans, pension liabilities, etc. In short, your total liabilities are the sum of your long-term and short-term liabilities. Your total liabilities plus total equity must be the same number as your total assets. If both sides of this basic accounting equation are the same, then your book’s “balance” is correct. As you can see, no matter what the transaction is, the accounting equation will always balance because each transaction has a dual aspect.

Limitations of a Balance Sheet

For example, if a business signs up for accounting software, it will automatically default to double-entry. Understanding your company’s liabilities will give you the full story behind your company’s finances and how much total debt you’ve incurred. You can use a simple accounting formula to calculate your total liabilities by hand or incorporate helpful accounting software to simplify the process.

- Current assets are typically those that a company expects to convert easily into cash within a year.

- An asset is a resource that is owned or controlled by the company to be used for future benefits.

- It is important to understand that balance sheets only provide a snapshot of the financial position of a company at a specific point in time.

- Other names used for this equation are balance sheet equation and fundamental or basic accounting equation.

- Creditors are owed $175,000, leaving $720,000 of stockholders’ equity.

Balance sheets are typically prepared at the end of set periods (e.g., annually, every quarter). Public companies are required to have a periodic financial statement available to the public. On the other hand, private companies do not need top 10 best mac accounting software for your small business to appeal to shareholders. That is why there is no need to have their financial statements published to the public. It may not provide a full snapshot of the financial health of a company without data from other financial statements.

Shareholders’ Equity

The accounting equation ensures that the balance sheet remains balanced. That is, each entry made on the debit side has a corresponding entry (or coverage) on the credit side. This straightforward relationship between assets, liabilities, and equity is the foundation of the double-entry accounting system. That is, each entry made on the Debit side has a corresponding entry on the Credit side.

It is used to transfer totals from books of prime entry into the nominal ledger. Every transaction is recorded twice so that the debit is balanced by a credit. When the total assets of a business increase, then its total liabilities or owner’s equity also increase. The balance sheet reports the assets, liabilities, and owner’s (stockholders’) equity at a specific point in time, such as December 31. The balance sheet is also referred to as the Statement of Financial Position.

Business owners use these financial ratios to assess the profitability, solvency, liquidity, and turnover of a company and establish ways to improve the financial health of the company. These operating cycles can include receivables, payables, and inventory. This will make it easier for analysts to comprehend exactly what your assets are and where they came from. Tallying the assets together will be required for final analysis.

In this guide, we will take you through each step required to calculate liabilities. Additionally, a company must usually provide a balance sheet to private investors when planning to secure private equity funding. Like assets, liabilities can be classified as either current or noncurrent liabilities. Noncurrent assets include tangible assets, such as land, buildings, machinery, and equipment. The revenues of the company in excess of its expenses will go into the shareholder equity account.