What is the Accounting Equation? Basic & Expanded Formula Explained

Metro Corporation collected a total of $5,000 on account from clients who owned money for services previously billed. To learn more about the income statement, see Income Statement Outline. The 500 year-old accounting system where every transaction is recorded into at least two accounts. This transaction brings cash into the business and also creates a new liability called bank loan.

What is the difference between an asset and a liability?

Long-term liabilities are any debts due more than one year in the future, while short-term liabilities are due within the year. A company should make estimates and reflect their best guess as a part of the balance sheet if they do not know which receivables a company is likely actually to receive. For instance, accounts receivable should be continually assessed for impairment and adjusted to reveal potential uncollectible accounts. Some financial ratios need data and information from the balance sheet.

To Ensure One Vote Per Person, Please Include the Following Info

Assets represent the valuable resources controlled by a company, while liabilities represent its obligations. Both liabilities and shareholders’ equity represent how the assets of a company are financed. If it’s financed through debt, it’ll show as a liability, but if it’s financed through issuing equity shares to investors, it’ll show in shareholders’ equity. In our example, the increase in accounts receivable and inventory are the primary drivers of the overall increase in total assets.

The accounting equation

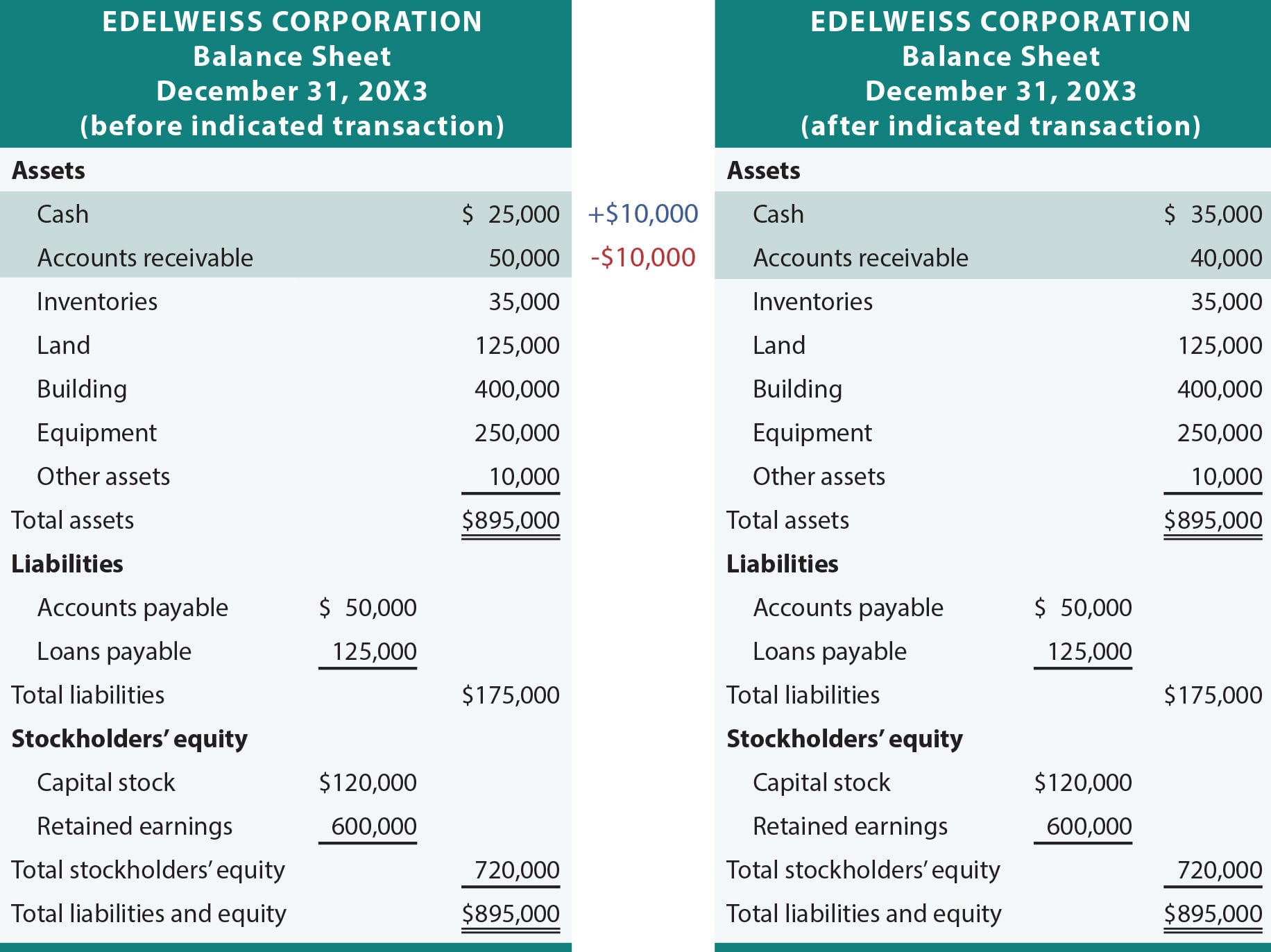

The difference of $500 in the cash discount would be added to the owner’s equity. On 12 January, Sam Enterprises pays $10,000 cash to its accounts payable. This transaction would reduce an asset (cash) and a liability (accounts payable). On 5 January, Sam purchases merchandise 5 reasons to reconsider your accounting strategy for $20,000 on credit. As a result of the transaction, an asset in the form of merchandise increases, leading to an increase in the total assets. Calculating the change in assets on a company’s balance sheet is an important step when analyzing a business or stock.

What is the accounting equation?

Accounting equation describes that the total value of assets of a business entity is always equal to its liabilities plus owner’s equity. This equation is the foundation of modern double entry system of accounting being used by small proprietors to large multinational corporations. Other names used for this equation are balance sheet equation and fundamental or basic accounting equation. The accounting equation is the backbone of the accounting and reporting system. It is central to understanding a key financial statement known as the balance sheet (sometimes called the statement of financial position). The following illustration for Edelweiss Corporation shows a variety of assets that are reported at a total of $895,000.

Let us take a look at transaction #1:

Current assets are typically those that a company expects to convert easily into cash within a year. While stakeholders and investors may use a balance sheet to predict future performance, past performance does not guarantee future results. However, it is crucial to remember that balance sheets communicate information as of a specific date. So, let’s take a look at every element of the accounting equation. Understanding how the accounting equation works is one of the most important accounting skills for beginners because everything we do in accounting is somehow connected to it.

At the same time, Capital increased due to the owner’s contribution. Remember that capital is increased by contribution of owners and income, and is decreased by withdrawals and expenses. Taking time to learn the accounting equation and to recognise the dual aspect of every transaction will help you to understand the fundamentals of accounting.

- You will need to tally up all your assets of the company on the balance sheet as of that date.

- Assets, liabilities, and stockholders’ equity are three features of a balance sheet.

- The table below summarizes the company’s assets for the past two year-end periods.

- The capital would ultimately belong to you as the business owner.

- In this case, Speakers, Inc. uses its cash to buy another asset, so the asset account is decreased from the disbursement of cash and increased by the addition of installation equipment.

Cash (asset) will reduce by $10 due to Anushka using the cash belonging to the business to pay for her own personal expense. As this is not really an expense of the business, Anushka is effectively being paid amounts owed to her as the owner of the business (drawings). Required Explain how each of the above transactions impact the accounting equation and illustrate the cumulative effect that they have. Capital essentially represents how much the owners have invested into the business along with any accumulated retained profits or losses. The capital would ultimately belong to you as the business owner.